Social Security Workshop

Social Security Basics

Social Security can be a major component of your retirement. You CAN’T spend through it, so your Social Security payments NEVER run out. Unlike most of your other retirement assets, it never spends down to zero. It’s always there for you!

People dismiss the importance of Social Security and subsequently make major mistakes regarding Social Security elections, timing, and decisions. According to a recent Yahoo Finance article, 96% of Americans do not get Social Security right. Let’s see if we can fix the misinformation and get Social Security right. You have paid into the system and agonized over FICA taxes for years. Now learn how to get back all you legally can.

People tend to spend way more in retirement that they plan for. Let me ask you, when do you spend more money, during your normal work week or during a week on vacation? Surely your answer will be during a vacation. What is retirement other than a permanent vacation? Any notion that you may spend less in retirement is not usually realistic. Unfortunately, most financial planners mistakenly assume you will spend less in retirement, which is why many people blow through their retirement savings early. This is due to travel, hobbies, and indulging grandchildren, etc. In early retirement you will finally have time to indulge in previously delayed desires, resulting in spending that reduces your retirement assets. In later retirement, due to increased health care expenses, you may involuntarily wipeout your assets. But Social Security may be your safety net as it will never run out!

Other assets may have a lifetime income benefit, such as some annuities, but the value of those fixed benefits may be diminished by inflation. With current out-of-control government spending and recent dramatic spending due to Covid-19, inflation—often caused by government spending—is nearly certain to increase, perhaps into double-digit inflation like we had in the 1970s and 1980s.

Social Security may become your retirement hero because of the built-in government guarantee that it will ALWAYS be there for you. It also has built-in cost of living increases (i.e., inflation protection). Therefore, if–or more likely when–runaway inflation comes charging back, Social Security may become the ONLY retirement asset you have that still has value.

Social Security Is Not Going Away

I have heard many people say, “But Social Security will not be around when I need it.” This misinformed attitude may be partially caused by the Social Security administration itself that often states that the Social Security trust fund will be depleted in 2034. This has mistakenly caused many to assume that social security will end in 2034.

Social Security payments do not depend on the trust fund. In fact, every year since 1986, Social Security tax payments and withholdings have collected enough to completely pay for retiree payments and provide a surplus to add to the trust fund. It is estimated that the surplus will continue growing through 2022. The point is that social security is paid for by CURRENT contributions to the system. After 2022 current contributions and the trust fund will combine to support the Baby Boom generation through 2034.

The trust fund is there to support the extra-large drain on the system, caused by the size of the Baby Boom generation. The strength of the system will then be supported by the size and wealth of the Millennial generation. It is true that after 2034 social security tax collections will only support about 80% of the retiree payments. Additional money could come from the general budget or by making small changes in the plan such as increasing FICA tax rates or increasing the Social Security starting age. Note that they did both in 1986, during the last Social Security overhaul.

Social Security is an unbreakable social contract that is widely supported and depended on by the elderly and that will someday include you. It is not going away.

When to Start Receiving Benefits

The most important decision you can make regarding Social Security is when you begin receiving monthly payments.

Understand that starting Social Security benefits may have nothing to do with when you retire, when you turn 65 or when you reach your Full Retirement Age, your FRA. It also has nothing to do with Medicare starting at age 65. You need to SEPARATE your decision about when to start Social Security benefits with these other dates.

Let’s begin understanding the rules by first establishing your Full Retirement Age. Again, this is not necessarily the day you should target for starting your benefits.

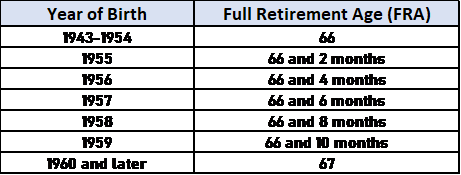

Your FRA is determined by your birth year as can be seen by the chart. Your FRA is a reference age used along with your actual payment start date to determine what your monthly payments will be. Your FRA will be between age 66 and age 67. By the way, I believe that FRA will soon be delayed till a year later for younger people (born before 1970) as we are all living longer. Delaying this age, maybe as much as a year like they did in the 1986 adjustment, could make the system self-funding after 2034.

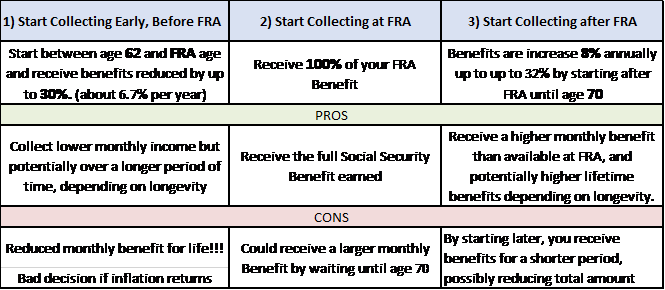

You can start receiving your benefits as early as age 62 and as late as age 70. Waiting can dramatically increase your monthly payments and potentially your total payments, depending on your life span.

In contrast, your benefits will be INCREASED 8% for every year you delay taking benefits after your FRA. Note that these increases will be PERMANENT for the remainder of your life. Depending on your FRA delaying starting your benefits to age 70 could permanently increase your benefits by 24 to 32 percent.

If you have already start taking your benefits and subsequently decide you wish for your benefits to continue growing, it is possible to suspend your benefits and then start them again later. You may even back up the clock by paying back up to a year of benefits previously paid out to you.

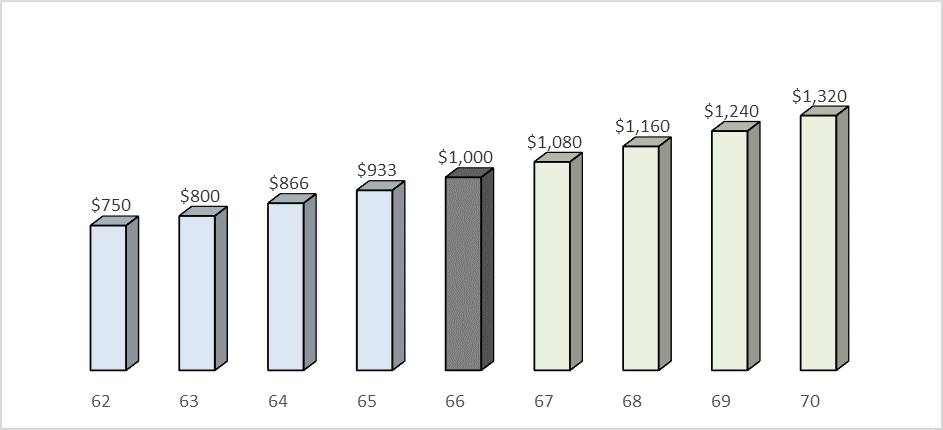

The bar chart shows the effect of starting early versus starting late. The chart assumes an FRA monthly benefit of only $1,000, which is actually much lower than most FRA benefits. It also assumes an FRA of age 66. On this bar chart starting at age 62 causes a monthly benefit of $750 while waiting to age 70 allows a monthly benefit of $1,320, which is 76% higher.

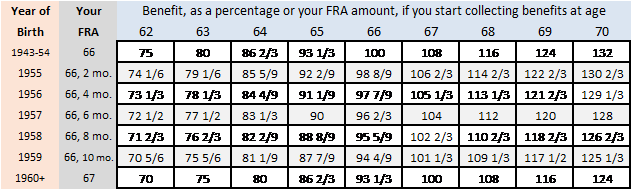

(show table)

The table shows the more detailed effects of how your birth year and your FRA, coupled with your benefit start year affects your monthly payments. Note that your actual payments are prorated by month and not just the year as shown in these simplified estimates.

You should also note that the payments shown do not reflect the cost-of-living adjustments which will be ongoing whether or not you have started your benefits.

Your Longevity Estimate Effects on Starting Date

So, when considering when to start your payments, you should also consider your longevity. If you delay starting your benefits in order to receive higher monthly benefits, this action could result in lower total cumulative benefits because of missing those early years of payments.

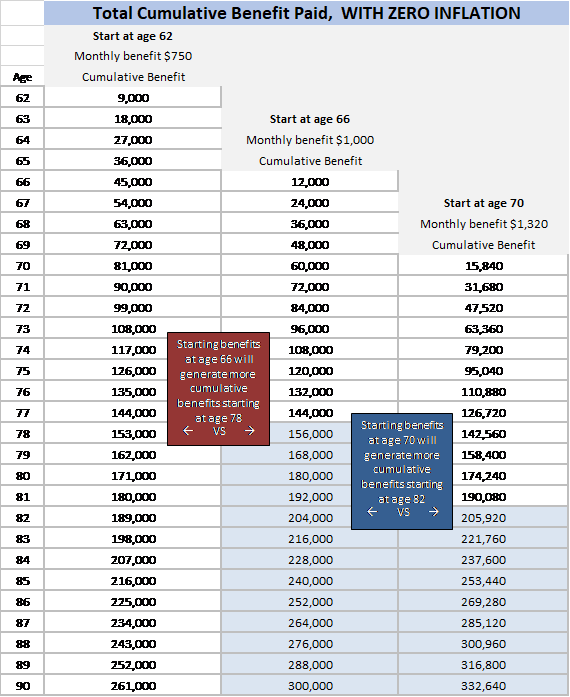

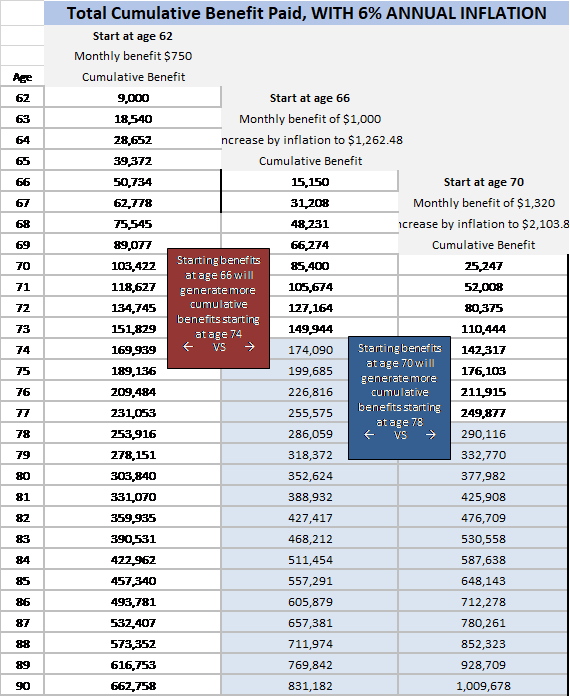

How long do you need to live to break even? The table below does the math for you, assuming your FRA is age 66 and your FRA benefit is $1,000. You would need to live to age 78 in order for the larger delayed payments to make up for missing four years of payments you forgo receiving by not starting at age 62. This is sometimes called your breakeven age.

Further, if you delay starting your benefits to age 70, you would need to live to 80 to break even as compared to an age 62 start, or age 82 to breakeven compared to an age 66 start.

How long should you assume you will live? According to a February 18, 2020 article in U.S. News & World Report, life expectancy for a 65-year-old woman, born 1/1/1955, living in the US, is 86.6 years and 84.1 years for a man. But despite average life expectancy, the article also recommends planning to live until at least 95-years-old.

The above breakeven analysis assumes zero inflation, which is not realistic. In fact, due to runaway government spending, I believe, that inflation will become a huge issue in the coming years.

Inflation has the effect of dramatically shortening the breakeven. Due to the effect of inflating the larger delayed monthly payments, you will achieve breakeven much earlier.

Let’s examine the breakeven points assuming a 6% inflation. If you wait until age 66 to start your benefits you would need to only live to age 74 in order for the larger inflation enhanced delayed payments to make up for missing four years of the payments you forgo by not starting at age 62. That’s four years earlier than the non-inflated breakeven points. Your breakeven for waiting to age 70 moves to age 76 compared to starting at age 62, and 78 compared to starting at age 66, in this 6% inflation scenario.

Breakeven analyses are popular for deciding when to start your Social Security benefits. However, I believe such analyses are absolutely the incorrect way to look at this. First, I believe most people or at least one person in a married couple will likely live long beyond the breakeven age. Further, I believe you should view Social Security as insurance for living longer than expected and insurance against high inflation. For these reasons you should let your benefits grow as long as possible before starting so that you will have more benefits when all your other assets are gone, and so that you will have a larger payment, growing with cost-of-living increase should inflation heat up.

Receiving Income While On Social Security

You should also consider if you will be continuing to earn income after you start your monthly benefits.

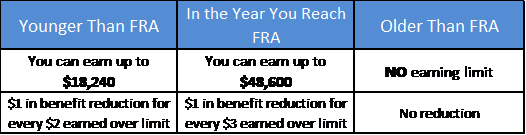

If you are older that your FRA, you can have unlimited earned income that will NOT affect your monthly benefits. There are no income limits at all after your FRA.

However, if you start your benefits before your FRA, earnings may reduce or even eliminate benefits. Note that earnings do not include investment gains, interest, annuity income, withdraws from IRAs or 401(k)s. Also, pension incomes (government or private) will not impact your benefits. Only EARNED income will affect your benefits.

Earnings are wages, bonuses, commissions, vacation pay, and self-employment net income that could reduce benefits if these total to more than $18,240 (in 2020; this is adjusted each year). For amounts over that threshold, for every two dollars earned, your social security benefits will be reduced by one dollar.

During the calendar year in which you reach your FRA but before you obtain your FRA you can earn $48,600 before any reduction applies, and then for every three dollars earned, your social security benefits will be reduced by one dollar.

Once again, you have a good reason to delay taking benefits because benefits after your FRA are not affected by earned income.

Your FRA Social Security payments are determined by averaging your highest 35 years of paying FICA taxes on earnings into the system, as adjusted for inflation. If you continue to earn past age 65, even into your 90s, if one of those years is one of your highest 35 years it could increase your benefits. So, keep making lots of money, and also get your monthly benefit checks.

Taxes on Social Security Benefits

Have you ever met someone who wants to pay more taxes? I am sure you think you have paid enough taxes. Your Social Security benefits have accumulated because of the FICA taxes you have been paying. Can you believe the government wants you to pay taxes on your benefits from paying those taxes? It’s outrages but it’s true.

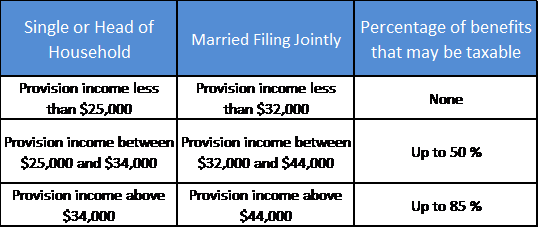

(show table 4.)

Here is the formula: add your Adjusted Gross Income (AIG), with your tax free (muni bond) income, then add half of your social security payments. Note that this includes all your unearned income sources. The sum is your “Provisional Income.” Then compare your provisional income and marital status with the displayed table. Up to 85% of your Social Security payments may be fully taxable at your ordinary income tax rate. That’s right, they tax you to fund your Social Security and then you may pay taxes when getting the money back, many years later.

Social Security Benefits for the Family

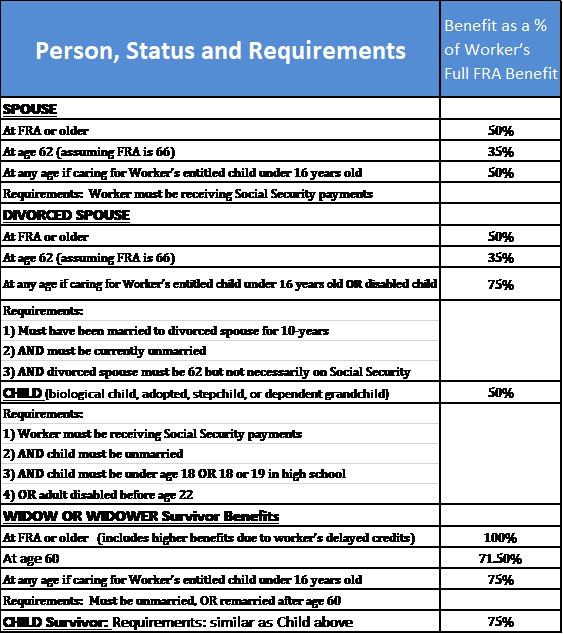

Your spouse is entitled to their own social security or up to half (depending on starting age) of your benefits whichever is greater (you must be receiving benefits). This does not reduce your benefits. Your spouse is also entitled to your full benefits should you die, but the amount is reduced if taken before their FRA.

Another way to view this is, if there are two spouses receiving benefit checks, and one spouse dies, the bigger check will continue to be received.

Your divorced and unmarried spouse is entitled to their own social security or up to half (depending on starting age) of your benefits, whichever is greater. If the divorced spouse is caring for a child under 16 or disabled child from the marriage, they may be entitled to up to 75%. A divorced spouse taking a spousal benefit does not reduce the previous spouse’s benefits. The catch is the marriage must have lasted for 10 years. So, if you are considering divorce after 9 years, you may wish to hang on a little longer. Taking this to the extreme, a person could get married and divorced every ten years, and then decide which x-spouse’s Social Security benefits would provide the greater monthly income. Maybe one of your X-spouses becomes a high wage earner?

Children’s benefits are the most often forgotten and not received benefits. People are having children later in life, particularly in May—December relationships. There are many couples where one older parent is already receiving benefits while a child is still in school. A child under 18, or under 19 and still in high school, or disabled before age 22 could receive an additional 50% of the parent’s FRA benefit. This applies to a biological child, adopted, stepchild or dependent grandchild. A child survivor of a parent’s death may be entitled to up to 75% of the parents FRA payment. I bet you know someone who meets one of these conditions whose child is not receiving the social security benefits they deserve. Help them out. Spread the word!

This is an abbreviated discussion of the multiple benefits of social security. I highly recommend a more complete review of your personal individual social security situation coupled with a complete financial plan that reviews how healthy your current path to retirement is progressing. Please use the Calendly.com link below to schedule an appointment to privately review your situation. Curtis Hill can provide much needed insight to your personal Social Security Situation.