Rollovers and the Tax-Deferral Deception

Why do People Delay Rolling Over Their Old 401(k)s

It always amazing to me how people leave money within their old 401(k) after they leave an employer. Many have multiple old 401(k)s that they have not done a rollover yet. This is particularly perplexing when I review the pathetic menu of investment choices available in most 401(k) plan. Typically, less than 25 choices most of which vary between mediocre to just plain poor. To add insult to injury, most corporate 401(k) plans have substantial fees (often hidden) that reduce your investment returns. So why do so many employees delay their 401(k) rollover to an IRA?

By rolling over to a self-directed IRA your investment choices may increase from a menu of a mere 25 options to over 25,000 investment options. What are the chances that you can find something better than with your current pathetic menu of investment choices in your 401(k)?

Maybe people delay their rollovers because they do not understand investments themselves and do have someone they can trust to help. Let me give you some suggestions in this area.

Avoid automatic or computer assistant advisors that try to force fit you to one of their model investments plans. Work with a real live professional investment advisor. Someone who has 20 years plus experience who has seen declining markets. Consider full service independent advisor that have the flexibility to offer a variety of solutions, versus some brand name financial firm affiliated advisor than has their own agenda. Avoid insurance only licensed advisors as they will only offer insurance related solutions. Similarly, avoid security only licensed people as they will only offer security related solutions. It’s best if you have a financial advisor who has both types of license so they are free to recommend what is best for you.

Let’s also examine the wisdom of 401(k)s, IRAs and tax differed plan in general.

A Little History on Retirement in America

Before 1970, most Americans had strong pensions that were design to meet a good deal of their retirement income needs. Many companies, unions, state and county governments, and other organizations provide pensions as an inducement toward employee loyalty and recruitment. However, that was about to change.

By the 1970, at the height of strong unions negotiations larger retirement pensions, corporate American was becoming inundated with pension liabilities that were become beyond their ability to support. Growing longevity also contributed to the liability. Corporate America appealed to congress for help. They needed the traditional corporate pension responsibility to be pushed off onto the employees instead of themselves.

In response congress passed the Employee Retirement Income Security Act of 1974 (ERISA). Among other provisions this act started the traditional IRA or Individual Retirement Arrangement. This was the first act of congress attempting to push the retirement issue onto individual instead of corporation. The public happily accepted this IRA tax law as a saving advantage and did not fully understanding how a path was being created to reduce corporate responsibility for retirement pensions.

But IRA were not enough. Under further pressure from corporate America, congress passed the Revenue Act of 1978, including a provision — Section 401(k) — that gave employees a tax-free way to defer compensation. The law went into effect on January 1, 1980

Corporate America soon discovered that employees where more interested in their 401(k) than their pension. Possibly because employees could more easily see the account balances and that provided a “glitter effect”. Perhaps because employees had more control of their 401(k). Maybe the employee just did not understand that their pensions were worth more than their 401(k)s.

Regardless of the reason, the corporate trend over that past few decades has been to reduce employer cost by pushing employees to rely on employee funded 401(k), 403(b), and 457 type programs. This is a backhanded way to shed the responsibility and cost of employee retirement, corporate paid for pension plans.

Unfortunate side effect has been convincing much of the American public that tax-deferral, like IRAs and 401(k)s plans are a good thing, which may not be true. This hoax has been promoted by banks, financial firms and employers who all benefit from us believe in this tax-deferral nonsense.

IRAs, 401(k)s, 403(b)s, 457s and Annuities Can Be Tax Time Bombs

Financial firms inundate us with promotions for retirement planning. Have you ever wondered why the focus is on retirement planning? For reasons that will be discussed later on this page, tax-deferred retirement accounts can be one of the most profitable accounts for brokerage firms. However, what’s profitable for financial firms is frequently not best for clients. The lack of liquidity inherent with tax-deferred accounts can be devastating in real life situations.

Let’s consider Jamie and Paris, a conservative couple who always sought the secure and responsible path. Taking advice from many well published sources, they were led to believe that maximizing investments in their individual 401(k)s was the most prudent course, and they should do so before considering any other investments. Since they were in their early forties, they selected stock mutual funds for their 401(k)s, as advised by their Human Resources Departments and other articles on investments for their age bracket. By October of 2007, their combined 401(k)s had grown to nearly $100,000.

When the 2008 financial crisis hit, Jamie and Paris’ combined 401(k) balance rapidly dropped by half the previous amount, to $50,000. By October of 2008, both Jamie and Paris were laid off and both had to make withdrawals from what was left of their 401(k)s to support their family. After paying state and federal taxes, plus penalties for early withdrawal from their 401(k)s, the remaining $50,000 only provided the couple with $25,000 in spendable cash.

Within only one year, their 401(k)s had dropped from $100,000 to only $25,000 in spendable after-tax cash! That $25,000 was all they had to keep them afloat until they were re-employed. With the stock market crash, taxes and penalties, their entire retirement account had been wiped out. This is just one example of how this tax-deferred retirement account didn’t work out in a real-life market situation.

Why are the negative side effects of tax-deferred accounts not adequately revealed by financial firms? Side effects such as lack of liquidity, the volatility of the stock market, and the effects of taxes and penalties can make tax-deferred accounts a huge financial mistake. Why then are taxed-deferred accounts so widely recommended, if families like Jamie and Paris can so easily be destroyed in a financial crisis? There is nothing unique about Jamie and Paris. Millions of other people have similar stories.

There is also nothing particularly unique about the 2008 crash, other than it was more widespread and affected more people than earlier crashes. Similar family crises also occurred during the 2000–2002 recession. Families experience similar events whenever there is a layoff, death, or medical crisis. The underlining problem is that tax-deferred retirement accounts do not provide the flexibility that is needed in real life.

As discussed in Chapter 1 of my book, the big financial firms use massive advertising campaigns to embed in our belief system that tax-deferred saving for retirement is the ultimate goal. Why are they focused on this narrow objective? Why do they feature IRAs, 401(k) rollovers, annuities, and other retirement-type accounts? Further, why are they focused on the size of the nest egg (where their fees are made) and not on after-tax access to your cash or what you actually need? The answer lies in their underlying motives.

Corrupting Motives:

When analyzing investment advice, you must always consider the financial motive of the one who is providing the advice. Most financial advisors, money managers, banks, mutual fund companies, etc., get paid based on two corruptive factors.

The First Factor: Their first corruptive motive is that fees are accessed based on the amount of money under management. Therefore, most financial companies attempt to maximize the dollar amount invested with them. Even a no-load mutual fund company is accessing an asset management fee based on the dollar amount invested with them. I’m sure you don’t believe that no-load equates to free any more than Santa Claus brings presents to good children. These huge no-load mutual fund companies make colossal profits and are not charities. Even a bank’s CD account has internal fees affecting the yield or interest rate. Note that a larger account value almost always equates to larger management fees. However, it does not always equate to a larger amount available to the client after taxes are considered.

The Second Factor: Their second corruptive motive is restricting access to money. If money can be held in a way that restricts access, the financial firm can continue to charge management fees for a longer time, thereby maximizing profits. Since tax-deferred retirement accounts have penalties and taxes for withdrawing funds early, this automatically limits withdrawals, which increases the financial firm’s profits. Also, convincing clients that money should be saved untouched in a retirement-targeted account allows the firm to charge fees for a longer period of time. Now we better understand the emphasis on long-term retirement accounts.

With a better understanding of their corrupt motives, let’s now focus on the tricks and techniques the big financial firms use to trap client money with the firm. I call these tricks the untrue financial truisms that big financial firms promote. They have been promoting these untrue beliefs for so many years that they have become ingrained in our financial belief system. Most investors seldom question these beliefs. They simply accept their validity without further examination.

Untrue Retirement Saving Truism #1:

Tax-deferred accounts, such as IRAs, SEPs, 401(k)s, 403(b)s and 457s, are the optimum vehicles for quickly growing retirement assets.

Big financial firms focus on growing retirement accounts quickly because taxes on gains are delayed until retirement. The great news for the financial firms is that without the drag of annual taxes and the tax-deferred nature of the deposits, these accounts typically grow faster and larger than taxable accounts. Firms love to supply charts, graphs and calculators showing this terrific growth. But these promotions are totally misleading.

The important issue to these firms is that larger balances result in higher management fees. Remember the financial firms’ motives? Further compounding their duplicity, firms seldom emphasize to their clients that these large balances do not belong to the account owners. These larger balances are jointly owned by the account owners, the IRS, state and other tax authorities. Account owners should realize that only part of the balance in these accounts belongs to them, even though they are paying management fees on the entire amount. A more correctly stated truism would be:

An IRA or 401(k) is a way to grow money that only PARTIALLY belongs to you, but for which you are forced to pay ALL the investment management fees on.

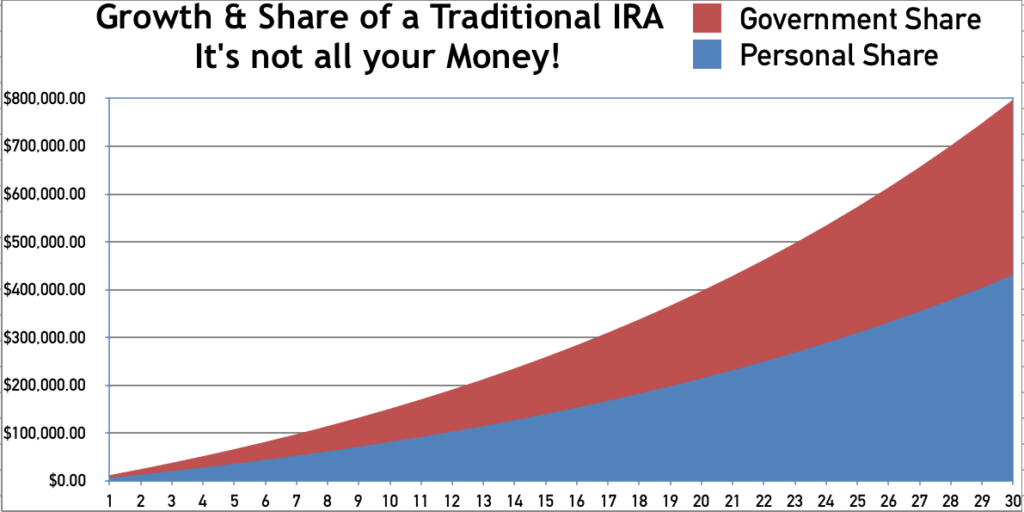

Many 401(k) participants are proud of their 401(k) balance and falsely believe their retirement days are secure. They don’t understand how little of these balances actually belongs to them. Their false belief is bolstered by financial planning software that ridiculously assumes lower tax brackets and rates in retirement. It is much more likely you will be in a higher tax bracket during your retirement. Chart 1 shows how little of your 401(k) balance belongs to you, just a little over half. The dark gray is your share and the light gray is the government’s share. The chart assumes a $1,000 a month contribution, with a 5% investment growth rate and a combined state, and federal tax rate of 46%.

In certain circumstances, the partial ownership by the investor may be less than half of the balance. As tax rates go up, which is extremely likely in the future, the account holder’s share is likely to decrease even further, becoming significantly less than half, maybe only 25%.

Your ultimate share of your retirement nest egg is determined by the future whims of government taxation.

Let me point out that Federal tax brackets are not adjusted for the cost of living in your area. If you live in a higher cost state such as New York or California, you will likely be in a higher tax bracket just because it takes more income to live there. These states also have higher state income taxes. The point is your retirement withdrawals from tax-deferred accounts in these states are likely to be highly taxed. Therefore, tax-deferral will be less successful in these states.

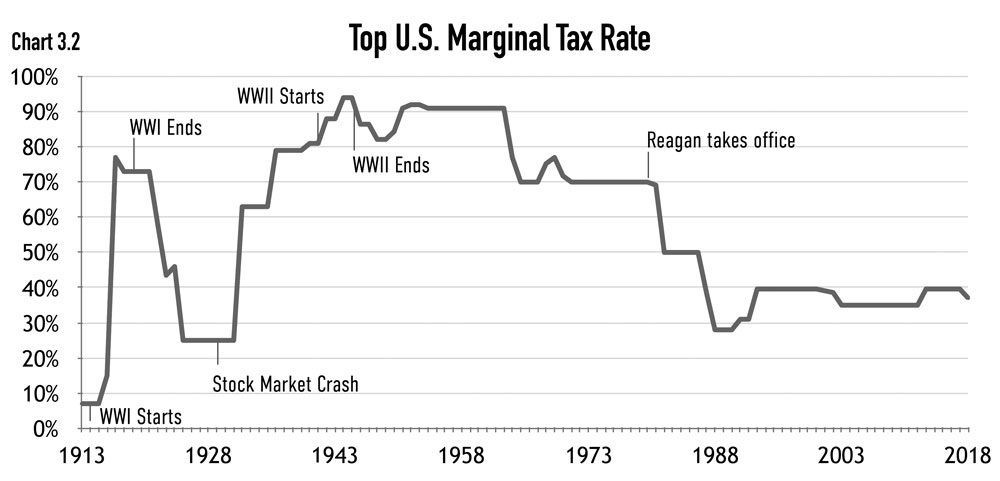

Already, in some states, nearly half of your retirement assets can be taxed away when you withdraw them. As tax rates continue to increase, which is almost a certainty with rising government deficits, combined top federal and state taxes rates could grow to over 75%. (Higher future tax rates are discussed in more detail in Chapter 5 of my book.) In fact, historically, the top marginal federal tax rates were always at or above 70% from 1936 to 1981. And that doesn’t even include state taxes. See chart 2 below.

(Source: TCP Urban Institute & Brookings Institution)

Is it wise to bet against history or learn from its lessons? It is wise to assume that deferred retirement assets will be taxed at a 75% rate. Stated differently, people should view tax-deferred accounts as only fractionally belonging to them, maybe only 25%. This means that in retirement you will withdraw four dollars to have only one dollar to spend after taxes!

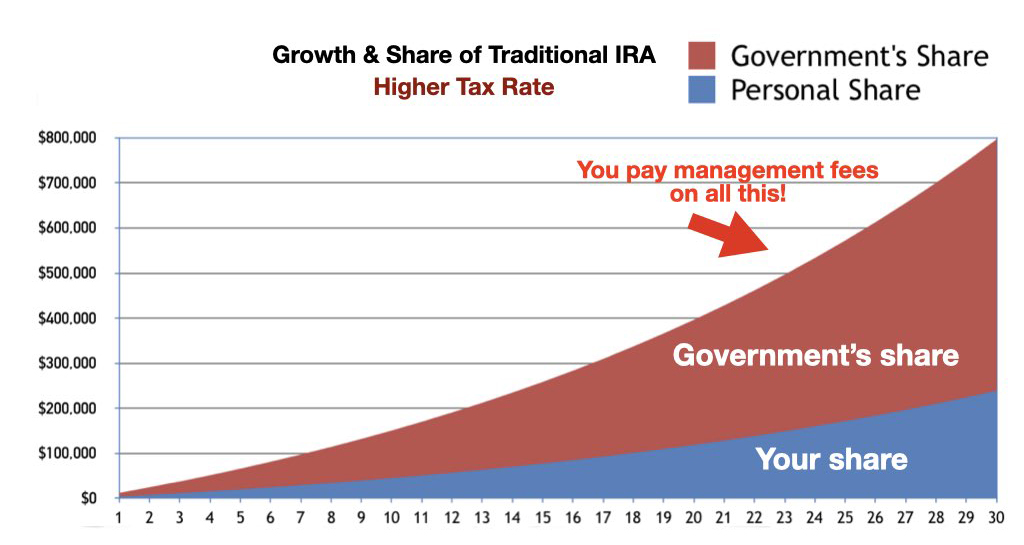

As is demonstrated in Chapter 5 of my book, future tax rates are almost certain to be much higher than today’s rates. Chart 3 demonstrates the future shares of your retirement assuming a combined state and federal tax rate of 75%. The chart assumes a $1,000 a month contribution with a 5% investment growth rate.

Of course, the big financial management firms will be happy to deduct their management fee on ALL the assets in these deferred accounts, which means the account owner ends up paying management fees for both his and the government’s share of the account. How do you feel about personally paying management fees for money belonging to the government?

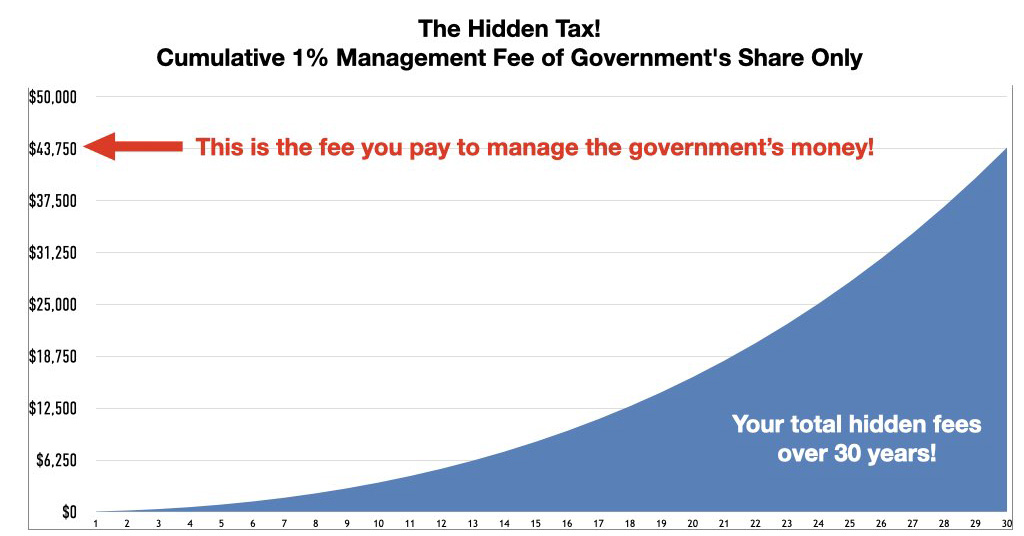

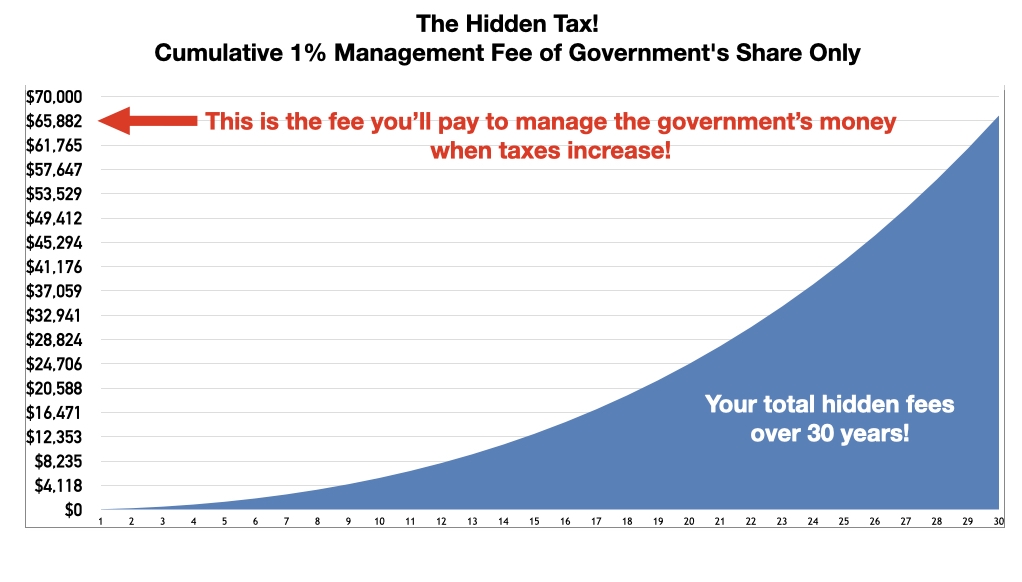

You are paying a huge hidden tax on your tax-deferred plans. All investment accounts have fees even if you are not aware of them. There is no free lunch. But since you can anticipate that much of your tax-deferred accounts will ultimately belong to the government (this is the red part of chart 1), you are paying fees to manage the government’s share of the investment. This fee resembles a hidden tax. How do you feel about paying this hidden tax to manage the government money? Assuming you put $1,000 per month into your 401(k), and assuming today’s combined state and federal tax rate of 46%, you could pay over $43,000 in hidden taxes over thirty years, as shown in chart 4.

This becomes much worse if you consider the likelihood of higher tax rates in your retirement years. In this scenario—putting $1,000 per month into your 401(k) and assuming a future combined state and federal tax rate of 75%—the hidden tax will amount to over $66,000 over thirty years, as shown in chart 5. How do you feel about supplementing the government by paying their management fees?

Untrue Retirement Saving Truism #2:

You are investing pretax dollars in tax-deferred accounts, such as IRAs and 401(k)s, and therefore the IRS is helping you save for retirement.

Sure, by saving pretax dollars there are more assets to build upon. Of course, your money will grow faster if you also defer taxes along the way. These are the major selling points for IRAs, 401(k)s, and many other retirement accounts. But is deferring taxes an advantage or a disadvantage?

With higher future tax rates, deferred taxation is a huge disadvantage of IRAs, 401(k)s, annuities, and retirement plans in general. However, remember the old marketing trick: if you can’t fix it…feature it!

Boy, do big financial firms like to feature this disadvantage. Many CPAs will feature current year tax savings without calculating the huge eventual tax liability, and they often discount the possibility of much higher taxes in retirement. Refer to Chapter 5 in my book for information that proves the likelihood of higher taxes later.

You are not avoiding taxes by putting money into a tax-deferred IRA or 401(k). You are merely delaying taxes. You should think of these as a loan from the IRS, but the principal repayment balance to the IRS increases with account growth. The loan repayment amount may also be increased by future higher tax rates. Plus, you pay management fees on the government’s share of the account. Is your CPA point this out to you?

CPA and financial planners are quick to say your wealth is growing faster because of the delay in collecting taxes. This delay allows additional interest (or investment gain) to be earned on interest before being reduced by taxes. This taxing delay allows for a higher compounding effect. Basically, your retirement savings’ dividends are allowed to have their own dividends before being reduced by taxes. But these effects are minuscule in today’s low return markets. Plus, the traditional way to calculate this compounding effect is to use a constant rate of gain each year. But in real life, the gains are not constant. Many years have negative gains. When random gains including negative gains are used, the compounding advantages are much smaller, if any.

The advantages of tax-deferral are often mistakenly compared against an assumed 37% ordinary tax rate in a non-deferred account. This is a ridiculous comparison. In reality, investments made in taxable accounts are mostly taxed at the long-term capital gains rate for both the gains (when taken) and the annual qualified dividends. These capital gains tax rates are far lower than ordinary taxes and top out at 20%. They are only 15% for joint income under $479,001 (in 2018). If your joint income is under $77,200 there are NO taxes on capital gains. If you also add the joint $24,000 standard deduction, $101,200 in joint income can occur before capital gain taxes are accessed. Therefore, many people pay zero or very little taxes on these investments held outside a tax-deferred account. How is tax-deferral better than zero taxes? Be aware that these tax rate advantages do not extend to interest payments on most bank-type investments and corporate bonds that are taxed at the higher ordinary tax rates.

So married couples earning less than $101,200/year (2018) would possibly pay zero taxes on capital gains on investments held outside of a tax-deferred account. More affluent married couples with joint income under $479,001/year (2018) would only pay 15% on the same investments. So why do advisors recommend tax-deferred accounts that will ultimately pay ordinary tax rates as high as 37%? The answer appears to be that we have been hoodwinked or brainwashed into believing in benefits that are marginal at best.

Have you ever seen the taxation of tax-deferred accounts compared to the lower taxation of long-term capital gains in regular accounts? It is not likely. The maximum capital gains are taxed at 20% but average much lower for most taxpayers, while taxes for ordinary income are around 37% for higher earners. If you do the math, the lower capital gains percentage can mean a higher payout even on a smaller nest egg. But your financial advisor probably won’t highlight this comparison because it may contradict their firm’s standard (and biased) selling practice which is to push more profitable tax-deferred accounts.

An additional consideration is a built-in tax-deferral on taxable accounts because the capital gains taxes are not charged on stocks until sold. This means you could be holding investments for many years, deferring taxes until you sell the security. Since the low tax rate advantage of regular taxable accounts is not often fully explained, it exposes how desperate financial firms are to convince you that tax-deferral is better, furthering the tax-deferral deception.

Any minuscule advantage of compounding is easily offset by the risk of much higher taxes in retirement. Most people underestimate the risk of unknown future tax rates. Let’s compare it with other risks. Would you take out a mortgage loan without knowing what interest rates or payments would be? Would you accept a new job without knowing what your salary would be? Would you buy a car without knowing what the price or monthly payments are? If not, then why would you risk your retirement on unknown factors (such as taxes) that are almost certainly going to change in a negative way.

These tax-deferred plans may have worked better twenty years ago, when government deficits were more under control and tax rates looked to be stable. But many professionals are still promoting these plans out of habit, without rechecking their math against likely future higher tax rate hikes. Yes, saving on current year taxes is nice, but this only forces you to pay a much larger tax bill in retirement.

Would you rather pay taxes on the seed or on the much larger crop after it has grown? Which would have the smaller tax bill, and which would have the larger?

Paying taxes on the seed—the smaller portion—is obviously the better deal. Paying taxes now at a known tax rate is more sensible than gambling on unknown (but likely much higher) future tax rates. However, many advisors recommend paying taxes later because they have been trained by their firm to believe that this is the proper recommendation. But the truth is larger account values of tax-deferred accounts create more fees for the financial firms. They simply shrug off the huge tax burden in retirement by making ridiculous, misleading statements such as “Your tax rate will likely be lower in retirement since you have no job income.” This false assumption is easy to disprove, but big financial firms continue to promote it, and have been for so long, it has become part of our corrupted financial beliefs. No, you won’t have employment income during retirement but you will have taxable income from tax-deferred saving withdrawals that are just a taxable.

The perception is—if you ignore liquidity, investment flexibility, and increasing future tax rate issues—IRAs and tax-deferred accounts can be better savings vehicles than taxable accounts. This is because annual gains are not taxable until later which allows for a larger compounding effect. In reality, this compounding is a marginal advantage. To offset that discrepancy, financial firms often misdirect the investor’s focus to the account size and growth. This narrow view is misleading since so much of this growth belongs to taxing authorities. Financial firms attempt to keep you blind to the negative realities of tax-deferred accounts.

Ignoring the negative issues of tax-deferred accounts is a questionable approach. It’s kind of like saying, other than that Mrs. Lincoln, how was the play? This book will point out better investment solutions that should be considered and included in a diversified retirement plan.

Untrue Retirement Saving Truism #3:

Don’t worry about taxes during retirement because you will spend less in retirement and will be in a lower tax bracket.

As a previous employee of a major investment firm, I heard this ridiculous statement many times. It is an incredibly bad, misleading and unrealistic argument used to whitewash concerns about tax-deferred retirement accounts. I have even heard CPAs and other tax professionals parrot this absurd untruth.

It is ridiculous to assume that your tax rate will be lower in retirement.

Yes, the taxable income from employment will end, but this income is normally replaced by pensions and withdrawals from tax-deferred accounts that are equally taxable. Generally, the only tax saving is lack of Social Security (FICA tax withholdings) since withdrawals from pension and IRA are not earned income. So, now the question becomes, does a family really spend less in retirement?

I have been giving financial advice for about 25 years, and I have seldom seen a family spend less in retirement than in pre-retirement. Once in retirement, people start focusing on play, travel, hobbies, spoiling their grandchildren and various other activities that all cost money. It’s hard to spend money while at work. In contrast, it’s easy to spend money during leisure or retirement. This includes activities that you didn’t have time for while still working.

How much more do you spend during vacations as compared to normal work days? Why would you believe that you’ll spend less during retirement?

Since expenditures are likely higher in retirement, taxable withdrawals are likely to be at a higher rate too, pushing people into a higher tax bracket. Additionally, in later years, health care expenses will also likely increase, causing more taxable withdrawals at an even higher tax bracket, since the tax deductibility of health care expenses has become very limited.

Tax rates have been rising for the past 35 years and are likely to continue to rise, ignoring the temporary tax rate reduction brought on by the Trump Presidency. Government deficits are also rising. The increasing national debt indicates that future tax rates are likely to go up. For the purpose of planning, I would estimate tax rates being 50% higher in 20 to 30 years, regardless of what political party is in power. To do otherwise is just reckless wishing. (Chapter 5 in my book will discuss in more detail some sobering realities about future tax rates and the national debt.)

Campaign promises aside, the Congressional Budget Office, a bipartisan group, states that “If Social Security, Medicare and Medicaid go unchanged, tax rates must change.

- The lowest 10% bracket would rise to 25%,

- the 25% bracket would rise to 63%,

- and the highest 39% bracket would rise to 88%.”

Untrue Retirement Saving Truism #4:

Saving through tax-deferred plans (IRAs, 401[k]s) is the ultimate and most responsible way to reach your financial goal.

The above statement is rubbish for several reasons. First, building financial assets should be for establishing financial independence and not be overly focused on retirement. Financial flexibility is lost when focused solely on retirement. Building after-tax (spendable) cash flow is far more important than building a tax-deferred nest egg, with its attached tax liability late in life, when you can less afford it.

Access to money is severely limited in tax-deferred plans, which is great for the financial firms collecting the fees. However, having access to funds is what determines your financial independence, and for these reasons, tax-deferred retirement accounts limit your freedom.

It is important to mention that tax-deferred accounts are not all bad. If your company’s 401(k) offers matching contributions for part of your contributions, certainly you should accept the free money even if you liquidate this money immediately after it is vested and fully belongs to you. However, contributing beyond the amount the company will match may be less wise.

However, a tax-deferred account is not the only way to build savings or a retirement plan. Remember that tax-deferred plans do not reduce taxes; they only delay taxes and will likely expose you to much higher tax rates later. One must also consider other options in order to increase diversification and likelihood of success. (Chapter 8 will reveal a better solution that prevents taxation during the accumulation years, plus provides tax-free access to your money any time.)

Untrue Retirement Saving Truism #5:

Tax-deferred accounts such as IRAs, SEPs, 401(k)s, 403(b)s and 457s are the optimum vehicles for quickly growing retirement assets because of matching contributions by employers.

Yes, some firms will match part of employee contributions. This is a nice benefit and, if they are offering free matching money, most likely you should take it. However, taking their free money should not also convince you that their plan is the optimal one for the bulk of your retirement savings.

There are two things you should consider:

- How much you must contribute in order to gain their match.

- The vesting period until their match contribution becomes completely yours.

If you contribute 10% of your salary to the plan, your employer may only match the first 2 or 3%. With such a plan, you may wish to curtail your contribution to not exceed what they will match. Other plans have other matching formulas such as matching 50% of your contribution for the first 6% of your contributions. Again, you may wish to curtail your contributions after reaching the maximum matching benefit.

Instead of contributing the maximum you can afford to such a plan, consider placing more money in alternative plans such as those discussed in Chapters 7 and 8.

Even if you do contribute to a retirement plan in order to gain matching contributions, consider the possibility of withdrawing those matching contributions after they become vested (i.e., when they are available for full withdrawal as your money). Granted these withdrawals could be taxable, but taxes now may be at a far lower rate than taxes at a later time. Plus, you likely have better investment options than the short and often mediocre choices within a 401(k) plan.

Untrue Retirement Saving Truism #6:

Tax-deferred accounts such as IRAs, SEPs, 401(k)s, 403(b)s and 457s are better than their equivalent ROTH type plans.

With lower retirement tax rate assumptions, circumstances can occur where a traditional plan can mathematically outperform ROTH accounts. Nevertheless, I greatly prefer ROTH accounts which remove the uncertainty of future tax rate increases that I feel are almost certain. ROTH accounts are also not subject to mandatory withdrawals like transitional plans, another significant advantage.

It’s time to snap out of it and think for yourself! An investor who thinks critically knows that tax-deferred retirement accounts are seldom the best options.

Excerpted from The Wealth Conspiracy, by Curtis Hill

Go to the Calendly.com calendar link below to schedule an appointment with an expert, Curtis Hill. Discover how a 401(k) rollover can change your retirement life for the better. Learn how “Not the same old advice” can benefit you